Sell More, Depend Less: Canadian Manufacturers’ Intentions Are Becoming Clearer Following Our Survey

A renewed interest in interprovincial sales, a continued—albeit cautious—attraction to the U.S. market due to its size and proximity, an ambition to triple online sales, and a strong desire to reduce dependence on the U.S. and China for components and raw materials. These are the key trends revealed by the recent survey conducted among manufacturers participating in the Well Made Here program.

As a renewed wave of patriotism sweeps across Canada, residential product manufacturers must grapple with familiar tariff barriers. Added to these are growing geopolitical tensions, prompting industry leaders to reflect—and perhaps act.

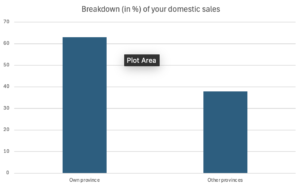

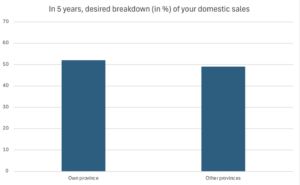

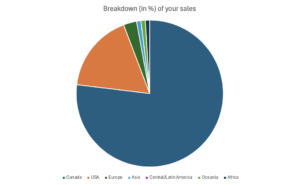

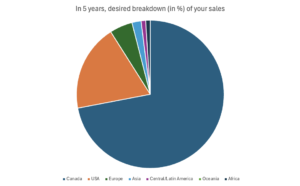

Unsurprisingly, more than 75% of our members’ sales and sourcing activities take place within Canada. Furthermore, most of them concentrate their domestic sales within their home province.

The graphs indicate that manufacturers still see untapped potential in other Canadian provinces.

A clear interest in interprovincial expansion emerges. But what’s holding them back?

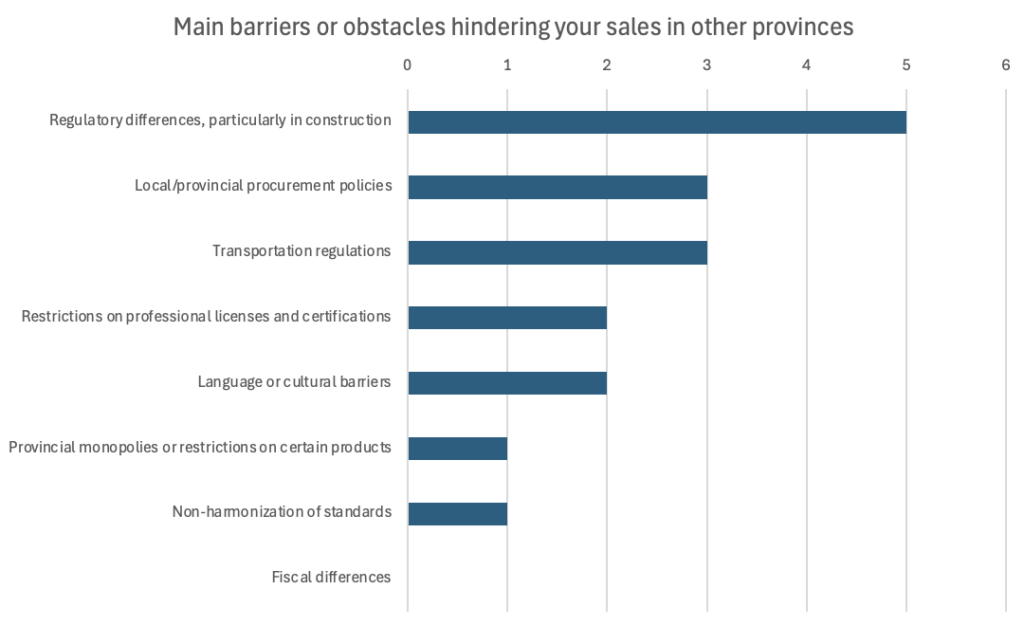

This bar chart highlights the main obstacles identified by respondents, who were asked to select up to three.

Regulatory discrepancies—particularly in construction—rank highest, followed by transportation regulations and local procurement policies. These barriers include safety standards, permits, regional preferences, operational methods, and labor laws, all of which pose a real challenge to interprovincial growth.

Comment from Richard Darveau, President and CEO of “Well Made Here”:

“Canada is vast, with its time zones and cultural regionalisms. To believe in total free trade within our borders may be wishful thinking. That said, we applaud the Carney government’s intent to make domestic trade more fluid.”

Local Sales vs. International Sales

Mainstream media often highlight that the U.S. is our top customer, with 75–80% of exports going there. However, now and in the future, it is domestic sales that most reliably sustain manufacturers in our sector.

Interest in Europe and Asia is rising, yet the U.S. continues—and will likely continue—to dominate residential product exports over the next five years.

Worth noting: only 5 out of the 20 respondents currently export to Europe. The distance and high shipping costs for heavy construction materials likely explain this limited presence.

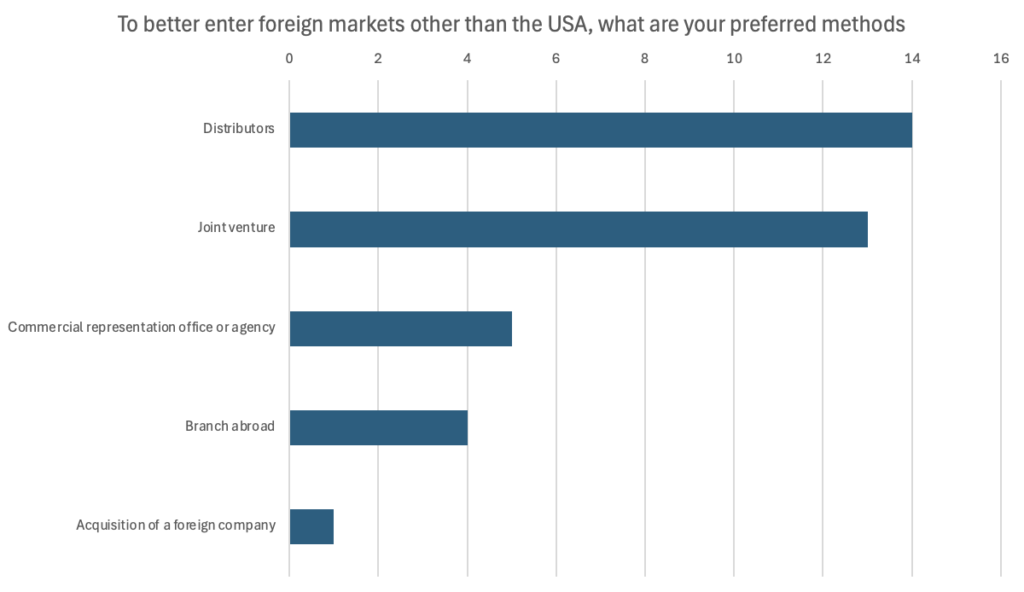

Preferred Export Strategies

Diversifying sales is easier said than done. The survey asked manufacturers which methods they favor.

Joint ventures top the list, followed by distributors. Hiring representation agencies ranks much lower.

Comment from Richard Darveau:

“Forming a joint venture in the U.S.? Absolutely—especially with administrations prioritizing businesses with local presence. But in my experience, when we’re talking about more distant markets, it’s often better to work with a strong distributor or agency than to manage a remote factory.”

Since the survey concluded, Well Made Here‘s leadership is considering requesting a mandate from its board to qualify distributors by geographic zones (e.g., Scandinavia, Southeast Asia, continental Europe, Mediterranean region, etc.), to represent the interests of several non-competing manufacturers.

In this regard, Mr. Darveau’s background—prior to entering the hardware industry—was steeped in international business. He led more than fifty trade missions around the world, many of which led to successful commercial agreements.

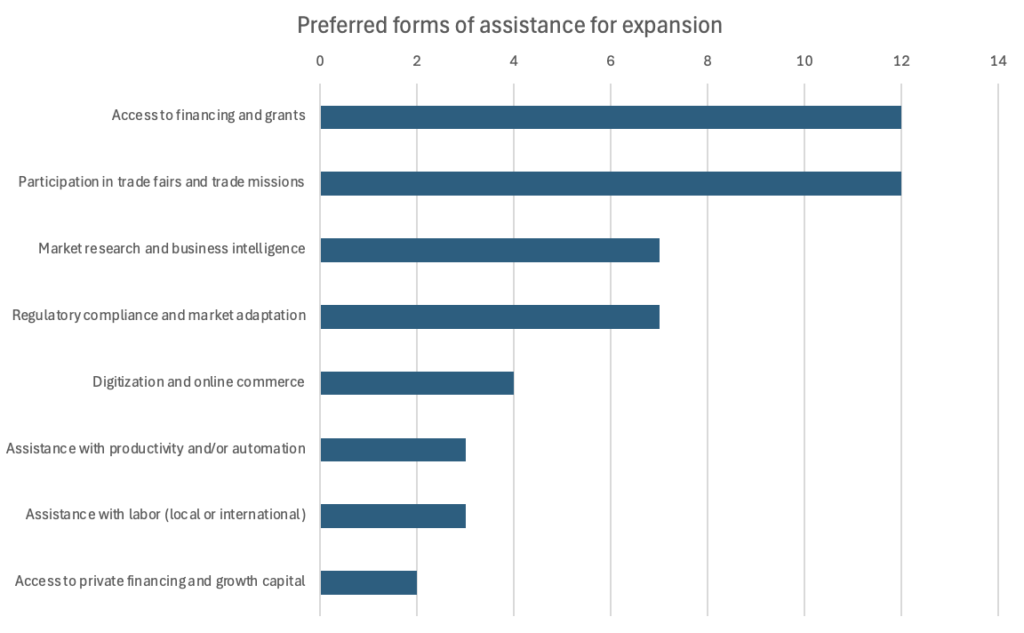

Support Needed

Respondents identified the three most crucial forms of assistance.

Access to financing—including subsidies—rivals participation in trade shows and missions as top priorities.

Well Made Here continues its efforts to raise awareness among the new Canadian government about the importance of supporting manufacturers that choose to produce—or even reshore—within the country.

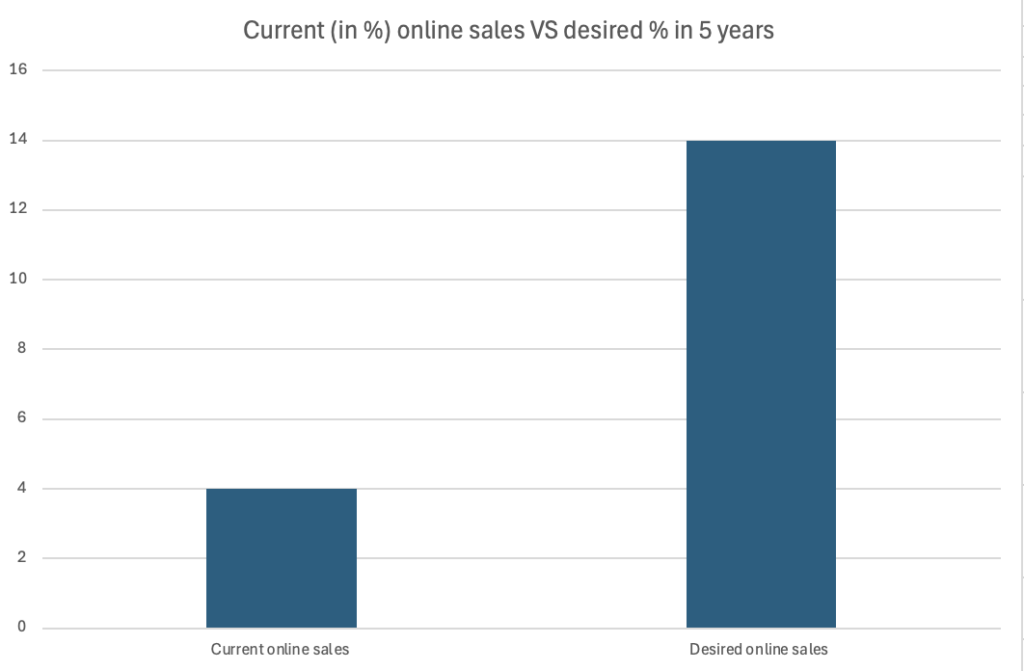

Online Sales

E-commerce is a defining trend of the 21st century. How are our manufacturers responding?

The chart illustrates sales through major digital platforms like Amazon, allowing manufacturers to reach wider audiences without major logistical or financial changes.

Manufacturers’ intentions show a projected 250% increase in online sales by 2030. This may sound impressive, but it will still only account for around 14% of total sales.

Comment from Mr. Darveau:

“It’s hard to say whether this growth will come at the expense of physical retail or represent an overall increase in revenue.”

According to Rachel Blondeau, manufacturers hesitate to invest in advanced e-commerce websites out of concern for disrupting their relationships with major buying groups.

A possible path forward? Mandating Well Made Here to act as a digital showcase and economic mission leader—backed by political allies—at select international trade events.

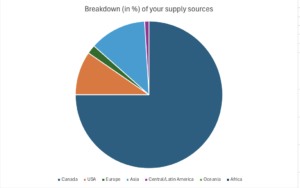

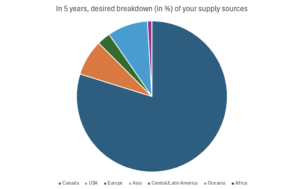

Let’s Talk About Sourcing

Let’s set sales aside and look at the other side of the coin: sourcing components and raw materials for manufacturers.

Interest in U.S. and Asian suppliers is declining, while European collaborations are gaining traction. Still, the strongest trend remains a desire to increase local sourcing.

Currently, three-quarters of components used are sourced within Canada. But our members want to increase that share even further.

Which leads us to an essential question: what kind of support could Well Made Here or the Canadian government provide to help strengthen ties with local suppliers?

It may well be worth considering a subcontracting trade show focused specifically on the manufacturing of hardware and building materials.

Click to view the full report

|

The survey was conducted from March 24 to May 30, 2025. Twenty companies out of approximately 225 manufacturers engaged in Well Made Here completed the questionnaire, with support from our intern Rachel Blondeau, who also led the analysis.

|