The organization is in good shape from an accounting point of view

The “Well Made Here” board of directors has taken note and is satisfied with the annual financial statements that were prepared by staff and revised by an independent accounting firm specializing in the management of non-profit organizations.

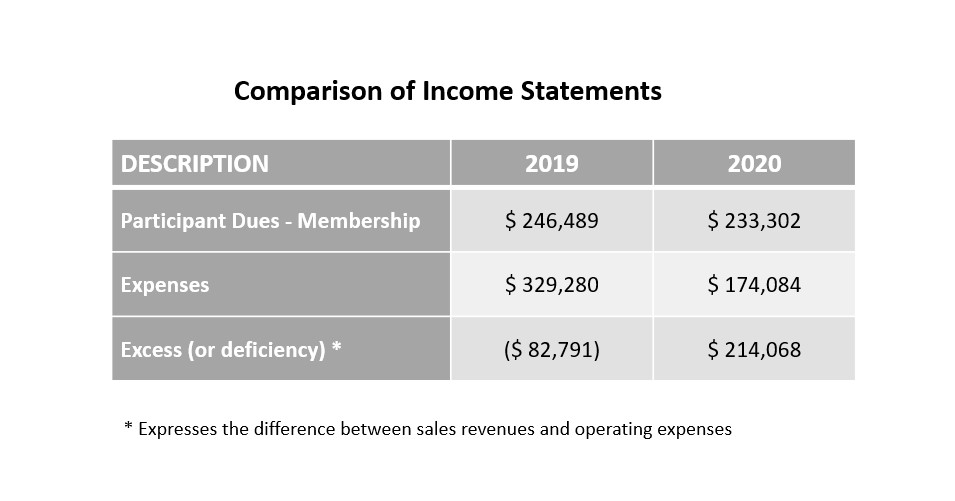

As it happens, the fiscal year ended December 31, 2020, resulted in a surplus of over $ 214,000, which contrasts with the shortfall of over $ 82,000 from the previous year.

Click here to view the financial statements in English or French.

Two or three important facts explain such a rosy financial situation.

About expenses of excess of revenues over expenses

First, let us recall that a vote by the AQMAT’s board of directors resolved to write off a debt of $ 112,000 accumulated by WMH in the form of salaries and shared office space.

Indeed, since the creation of the organization on October 31, 2018, WMH has benefited from the intellectual and physical resources of the AQMAT to ensure its start-up phase. However, it is common knowledge that a lack of oxygen can nip any start-up in the bud. With this generous contribution from the AQMAT, the organization is in resplendent financial health as it prepares to present itself as a potential partner to the Government of Canada.

Conversely, the emergency subsidies created precisely by this same government allowed WMH to receive $ 42,850 in 2020. It goes without saying that the amount will be significantly less in 2021 since funding for these federal programs has decreased and the coverage periods have been shortened.

Lastly, WMH had requested and obtained a loan from the federal government as part of a program in which two subsidies totaling $ 60,000 were granted to the organization, the whole accompanied with a nice gift since $ 20,000 may be retained; this amount is therefore added to the exceptional income for 2020.

These three items total $ 174,850. It is important to understand that they will not recur, therefore a similar return cannot be expected for the current fiscal year ending December 2021.

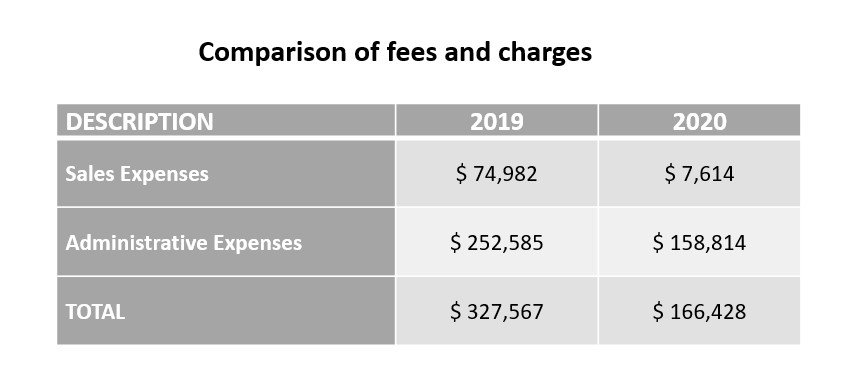

About sales and administration fees

On page 7 of the document, a significant reduction in costs directly related to the sales and administration of the program are recorded and show a drop from more than $ 327,000 in 2019 to only $ 166,428 in 2020. Due to the pandemic, an employee on maternity leave was not replaced, and the expenses resulting from the work for that role (travel, participation in trade fairs, marketing, etc.) were consequently minimal in her absence.

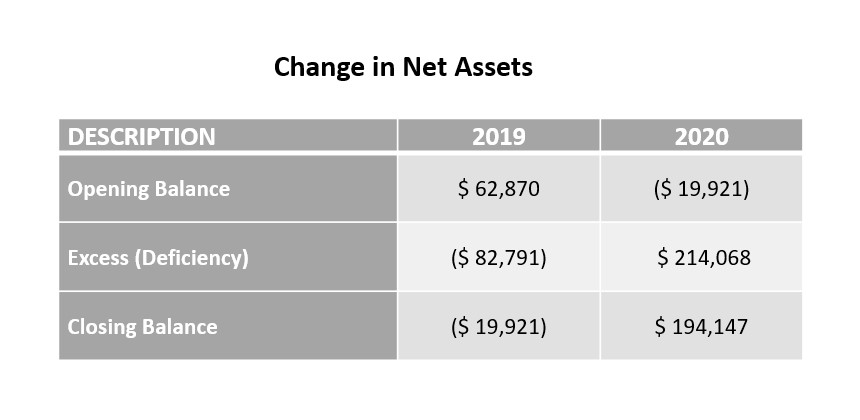

About net assets

Page 3 of the document summarizes the evolution of the value of the organization strictly from an accounting point of view. Evidently, for the above-mentioned reasons, net assets are currently significantly high, but this snapshot was captured on December 31 and the picture might be very different twelve months later. The fact of the matter is that no one knows exactly. It will depend on the extent of the support obtained from the government to carry out campaigns.